How well do you know your customers? We mean, really know them. Not just how they behave when interacting with your quick-service restaurants, but what they do when they’re out…

L.E.K Consulting & Civis Analytics Pulse Report | Fielded November 16, 2020

In partnership with management consulting firm L.E.K. Consulting, Civis is publishing “COVID-19 in the U.S.: Consumer Insights for Businesses.” This is the fifth and final installation of our COVID-19 Consumers Insights Series, which reflects the results of a recurring consumer pulse survey. Administered across 2020, the survey tracks the pandemic’s impact on consumer sentiment overall as well as by segment, geography and product. Each edition offers an updated perspective on the current landscape and what the lasting impact is likely to be.

This 5th edition of the survey was fielded on November 16th, 2020. Responses from approximately 2,400 U.S. adults were weighted to be representative of the U.S. adult population.

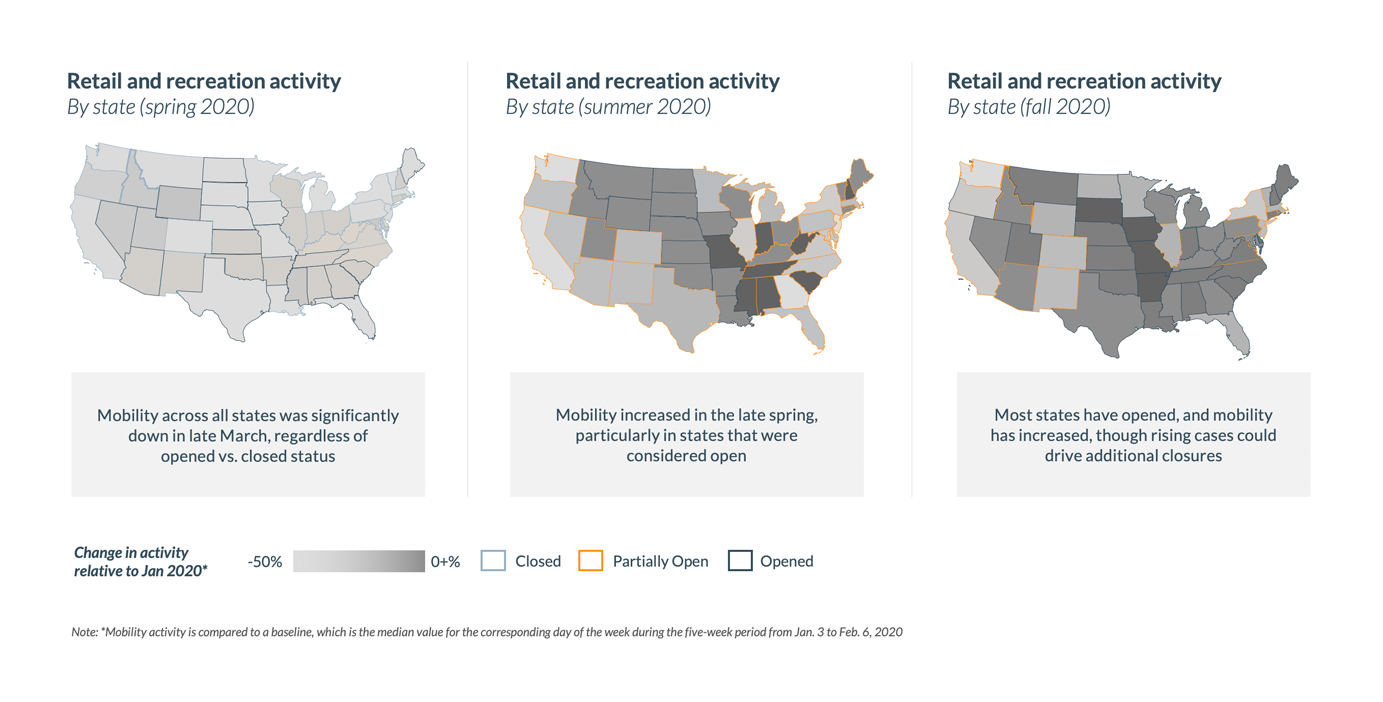

Consumer mobility has increased across the US

- As the country and businesses have continued to open, consumer behavior has gradually shifted back toward pre-COVID-19 levels.

- Consumer mobility, in particular, has dramatically increased since the height of the lockdowns in the spring. Google mobility data confirms an increase in retail and recreation activity across the country, with variance across states declining since restrictions began loosening in the late spring and early summer.

- Despite these recent increases, mobility is expected to remain below pre-COVID-19 measures in the immediate term, as rising cases drive additional closures across cities and states.

Consumer spending modestly rebounds across categories

- Consumer spending is gradually returning to normal, with expenditure reverting toward pre-COVID-19 norms in most key categories tracked by our research. However, expenditure on experiences and discretionary items still trails pre-COVID-19 levels.

- Average spend in essentials like dry groceries (up 10%-15%) and vitamins, minerals and supplements (up 15%-20%) remains high, but outsized increases from the spring and summer have mellowed somewhat as consumers have adapted.

- Spend in at-home categories like at-home TV streaming (up 15%-20%) and takeout (up 5%-10%) also remains higher than pre-COVID-19 spend, as many consumers continue to spend additional time at home relative to pre-COVID-19 norms.

- Average spend in experiential categories like restaurants (down 35%-40%), fitness/gyms (down 40%-45%) and entertainment (down 60-65%) is improving, though it remains significantly below pre-outbreak levels. Given many of these activities will be forced indoors or limited as cases rise and winter approaches, we would expect experiential spend to continue to lag that of other categories.

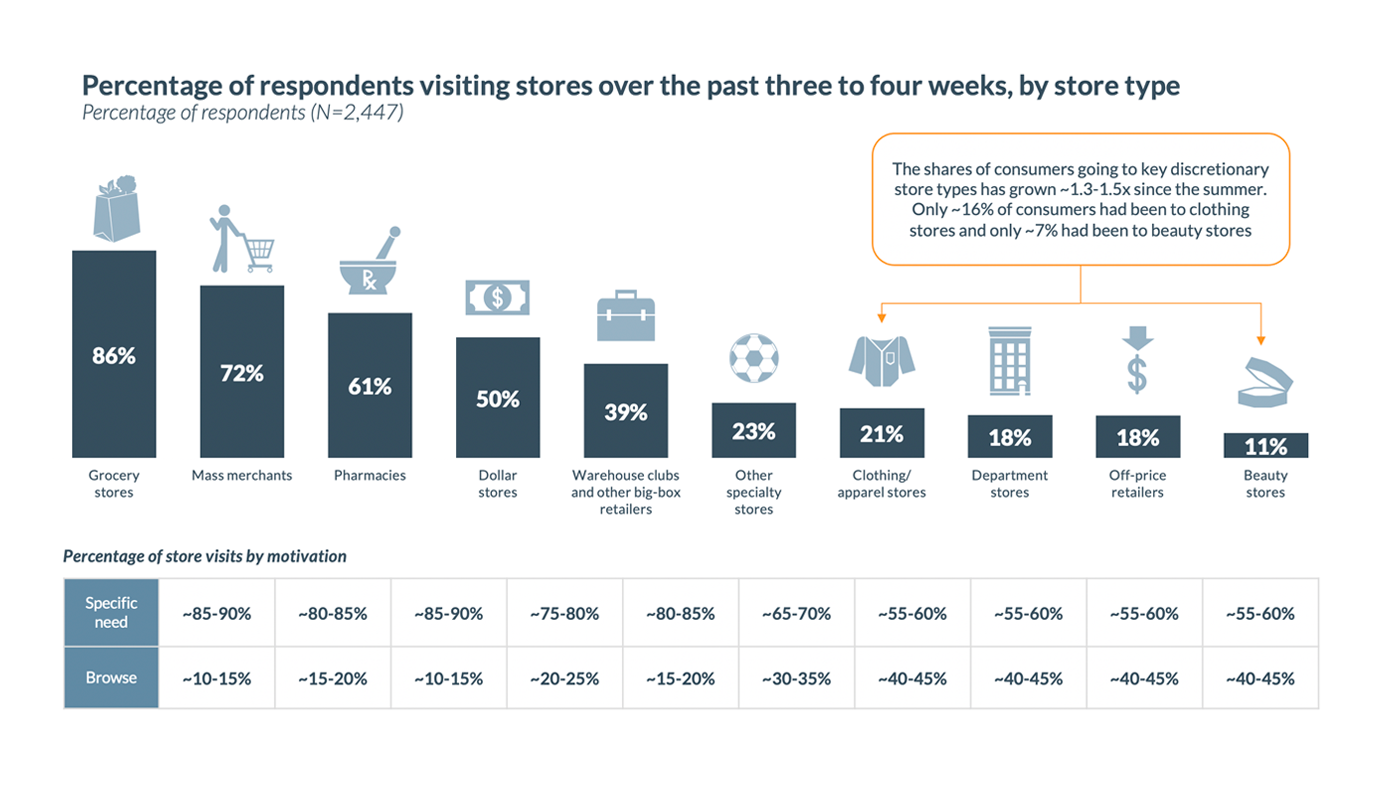

- Store visits are also shifting incrementally back toward pre-COVID-19 behaviors. Consumers are gradually returning to non-essential retailers, though the majority of these trips (across store types) remain focused on filling a specific need, rather than browsing.

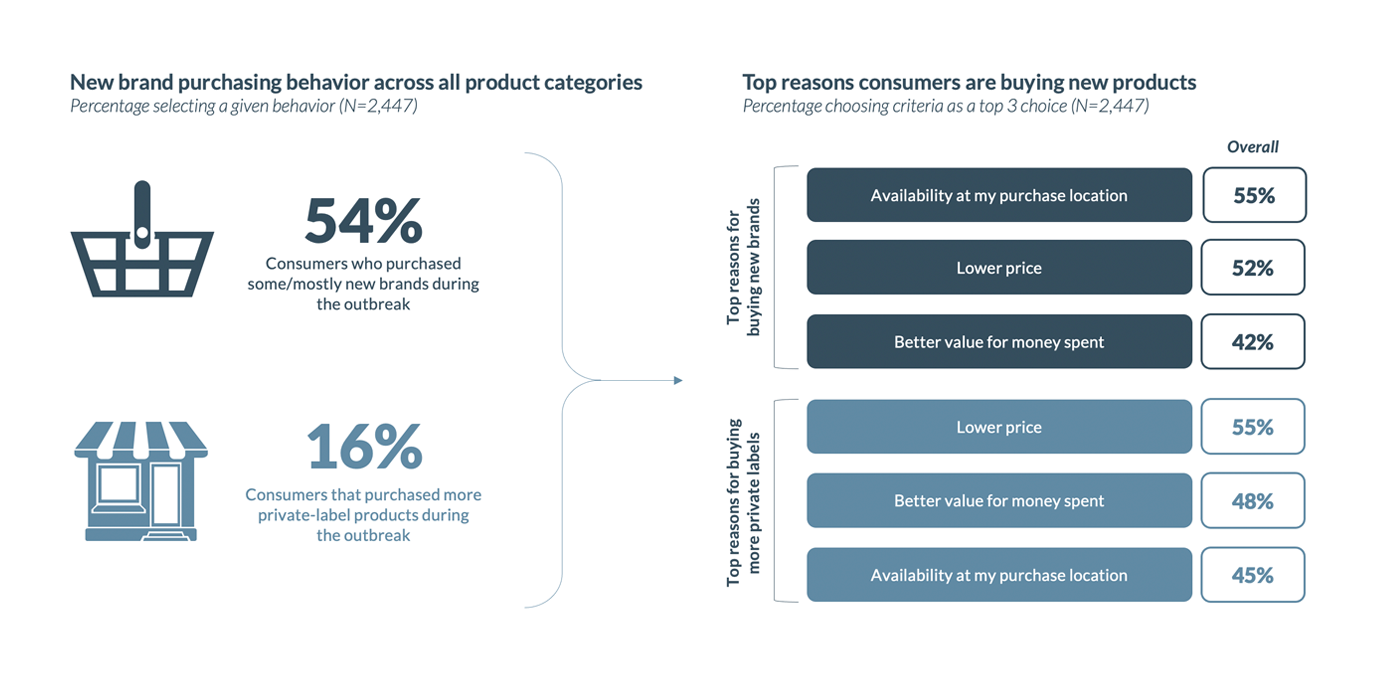

Brand purchasing behavior during COVID-19

- Consumers expect that COVID-19 will have a significant impact on the 2020 holiday season.

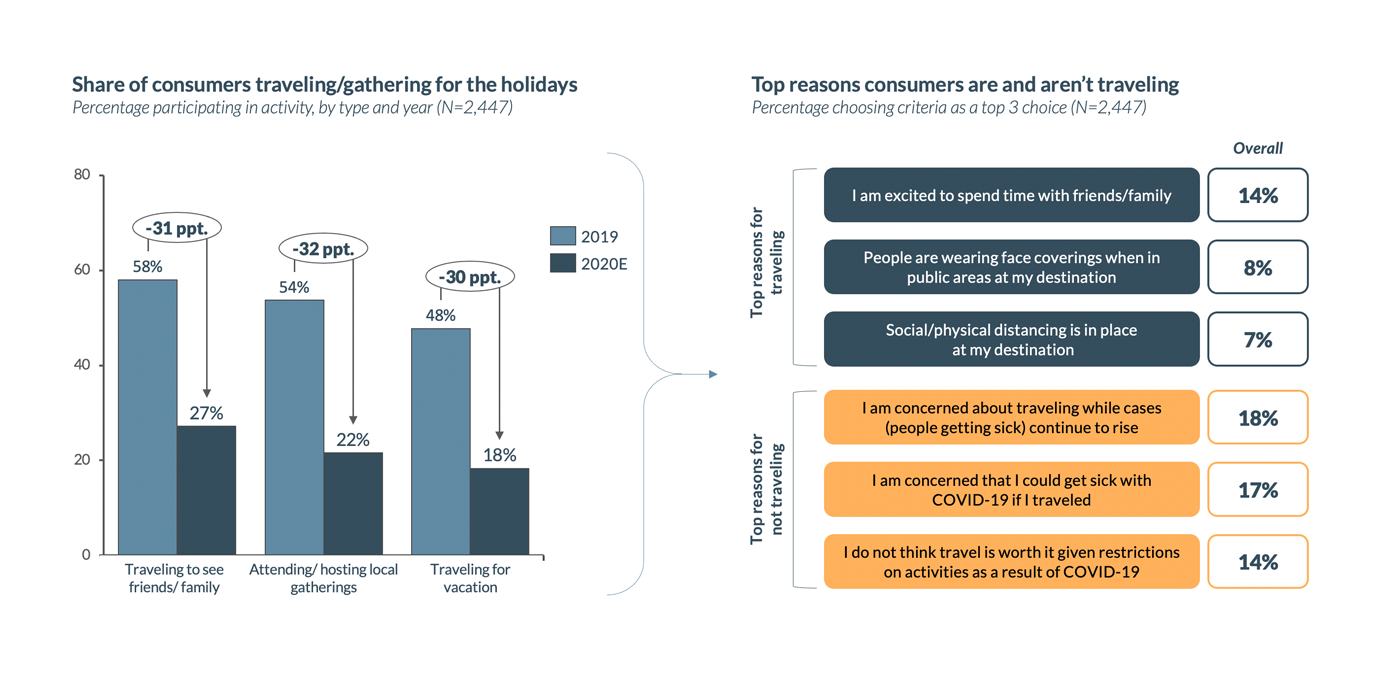

- Most notably, consumers will stay home this year. The share of consumers traveling to see family/friends (~27%, versus ~58% in 2019) or for vacation (~18%, versus ~48% in 2019) is down significantly year over year. The share of consumers attending local gatherings is similarly expected to be down in 2020 (~22%, versus ~54% in 2019).

- Recent spikes in COVID-19 are having a significant impact on this behavior, as concerns over rising cases and getting sick are the top reasons consumers are abstaining from travel this holiday season.

Holiday travel and gathering during COVID-19

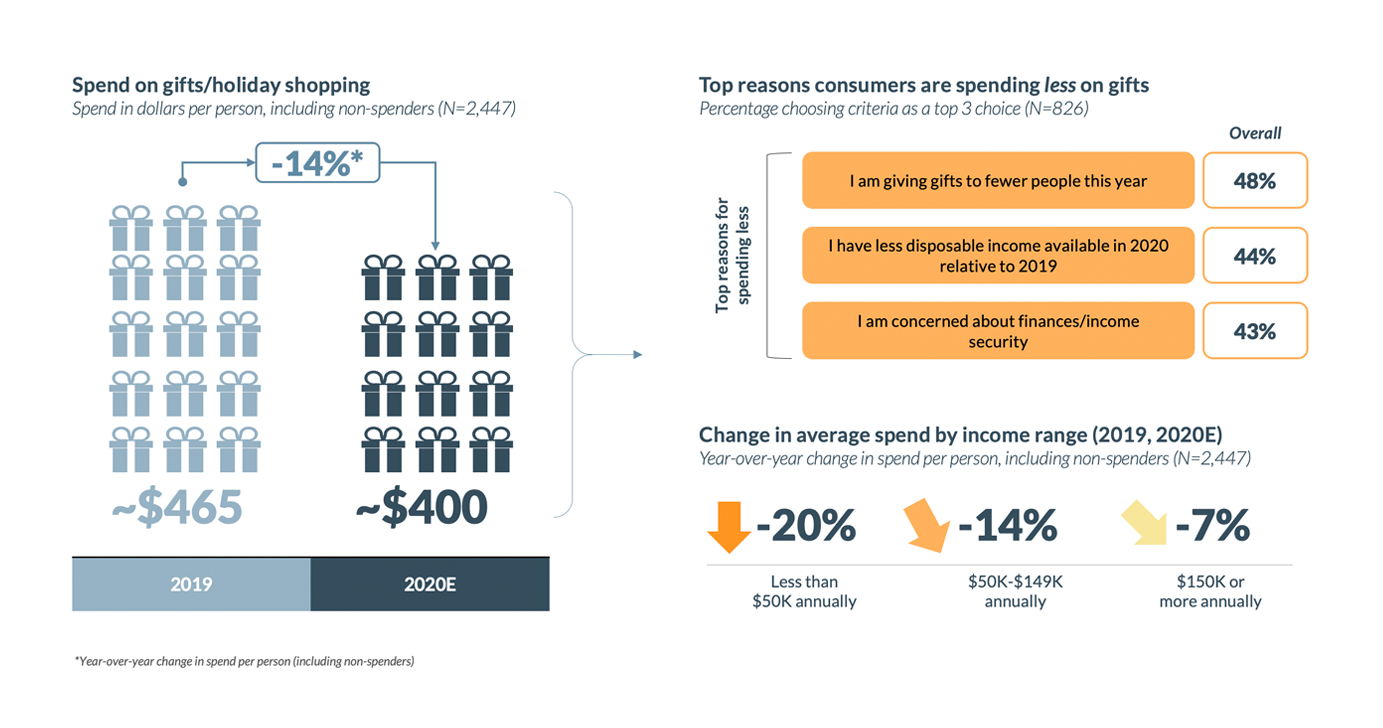

- Gift spending will be more resilient than travel, as most consumers will continue to give gifts this year. However, average spend is expected to decline ~14% (from ~$465 to ~$400 per person) as consumers report decreased discretionary income and plan to give gifts to fewer people.

- Across income levels, those making less than $50K per year are expected to reduce gift spend the most (~20%). Those making between $50K and $149K per year will reduce spend in line with the total market (~14%), while those making $150K or more will decrease spend by ~7%.

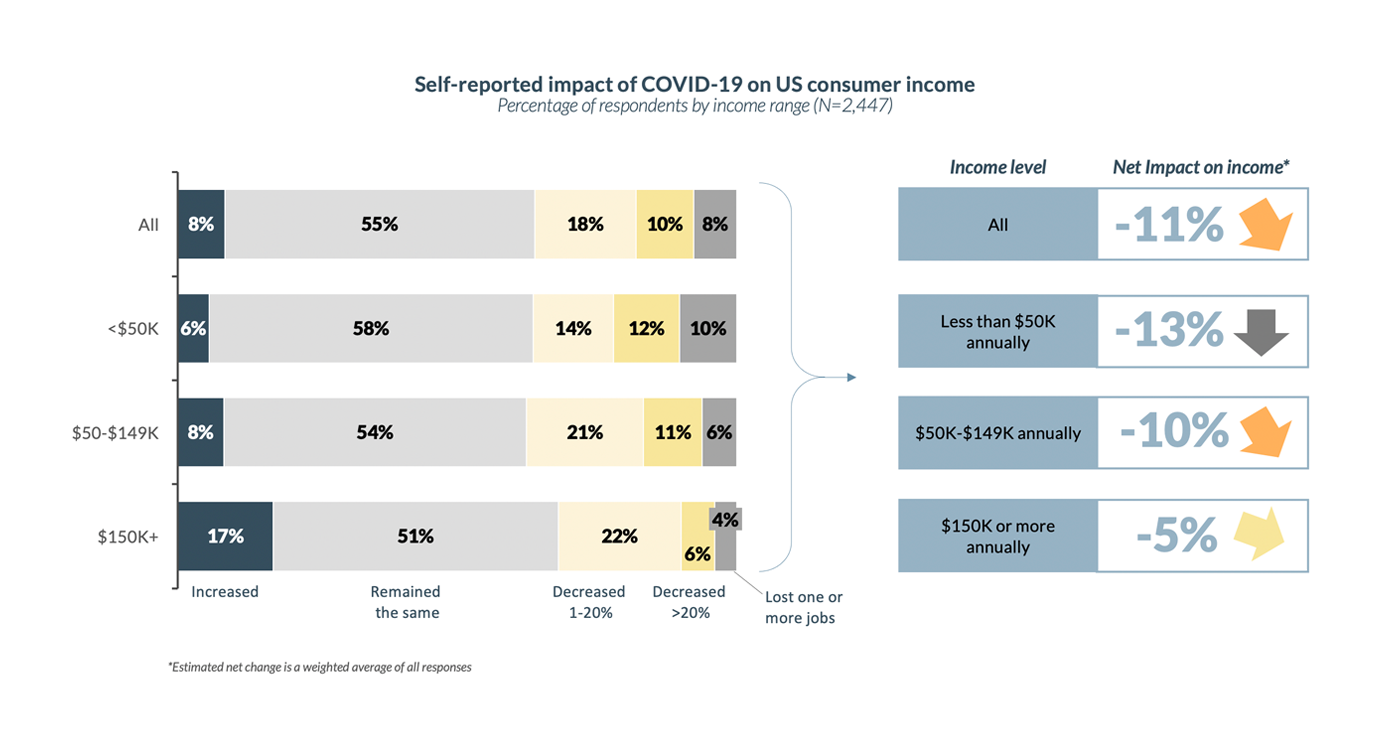

- These variable declines in gift spending align with the broader income impacts of COVID-19, with less affluent consumers reporting greater shares of income lost due to the outbreak. Approximately 22% of consumers with annual household incomes under $50K report losing greater than 20% of their income versus ~17% of those between $50K and $149K and only ~10% of those at $150K or more.

Long-term impacts on leisure travel

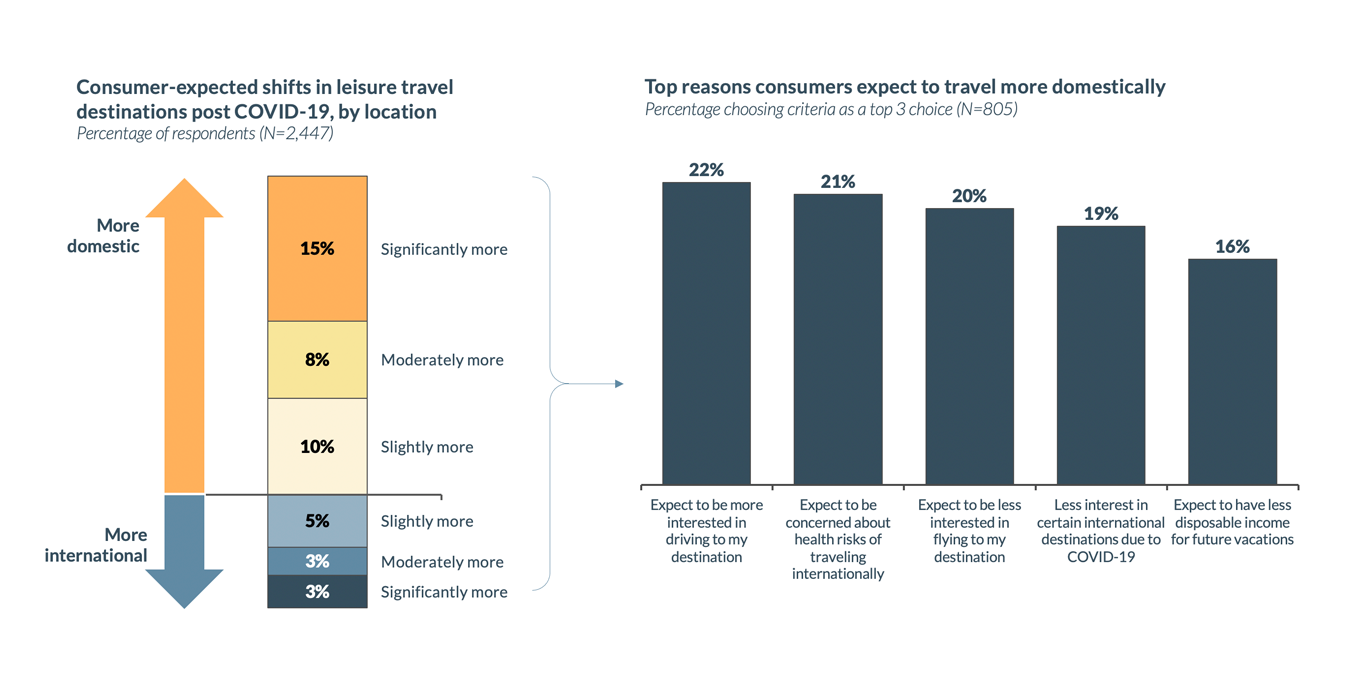

- Finally, consumers expect COVID-19 to shift their long-term leisure travel behavior, both in where they go and what they do.

- Approximately ~33% of consumers expect their travel to be more domestic post-COVID-19, most often because they expect to prefer to drive (rather than fly) to their destinations and will likely remain concerned about the health risks of international travel.

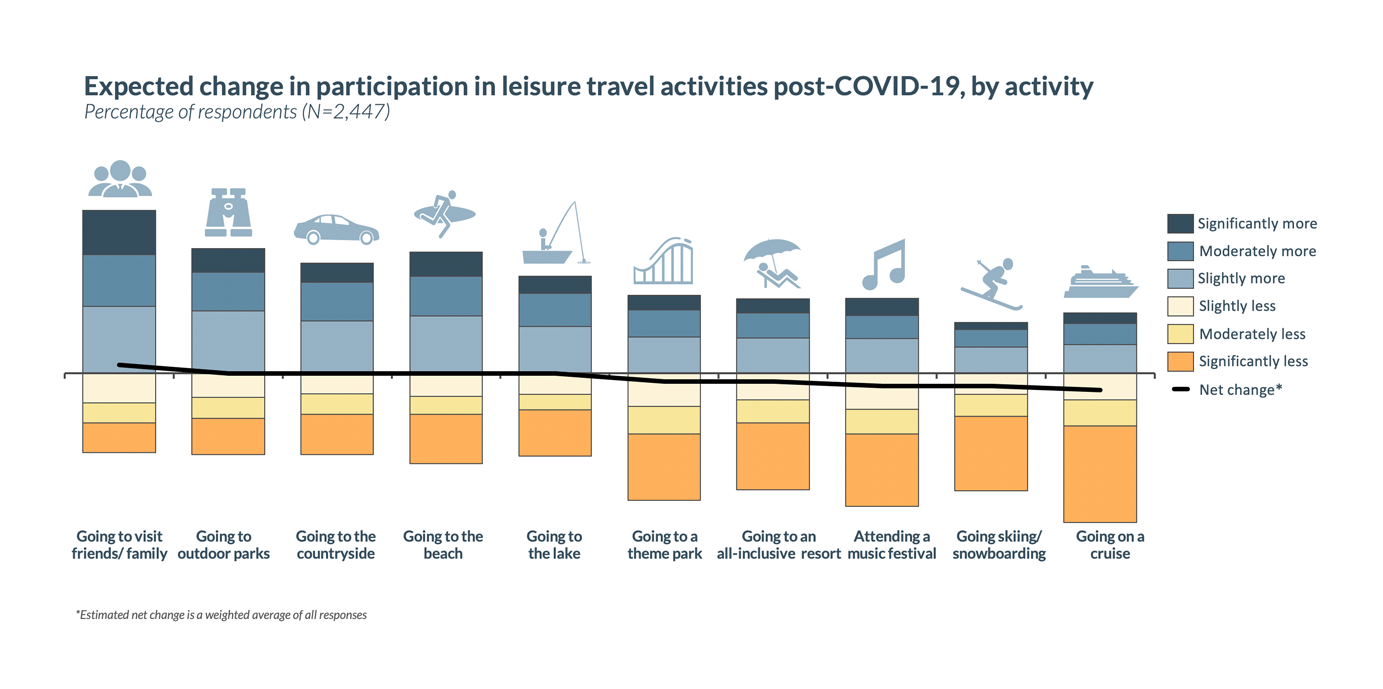

- Health concerns are also expected to affect consumers’ long-term leisure travel activity choices, even domestically. Consumers plan to participate in distance-able leisure travel activities a similar amount or more often once the outbreak is contained, but expect to reduce frequency of travel to more crowded locations.

- Participation in activities like visiting family/friends and going to parks, beaches, lakes or the countryside is expected to remain relatively consistent relative to pre-COVID-19 levels, while travel involving cruises, music festivals and all-inclusive resorts is expected to incrementally decline as consumers continue to seek out safer vacation options, even once COVID-19 is contained.

The full report with more insights, charts, graphs, and analysis can be downloaded by clicking the link below.

Download Full Survey Results from Prior Weeks

Week of Nov. 16: Report

Week of June 4: Report

Week of April 20: Report

Week of April 1: Report

Week of March 18: Report

Authors:

Civis Analytics

- Ellen Houston, Managing Director, Applied Data Science

- Masa Aida, Principal Survey Scientist

L.E.K Consulting

- Manny Picciola, Managing Director and Partner

- Maria Steingoltz, Managing Director and Partner

- Lauren DeVestern, Principal

- Kyle Dougher, Consultant